If youre not aged 49 years or over on 30 June 2015 concessional contributions up to 30000 are tax deductible and if youre 49 years or over on 30 June 2015 concessional contributions up to 35000 are tax deductible. Business travel and its associated costs like car rentals hotels etc.

Remember these are the sums that you are legally allowed to reduce from your taxable income.

Tax deductions for dummies. You can deduct half of your self-employment tax health insurance premiums and contributions to some retirement plans such as Roth IRAs SIMPLEs or SEPs. Office equipment such as computers printers and scanners are 100 percent deductible. Generally you can deduct real estate taxes personal property taxes.

Also you can claim home-office deductions such as a percentage of rent electricity and phone service if these costs are business-related. The Australian Taxation Office ATO calculates your taxable income using this formula. If you get a 1000 tax deduction and youre in the 22 tax bracket that deduction reduces your taxable income and saves you 220 when its all.

Assessable income tax deductions taxable income Most money you get from running your business is assessable income income subject to tax. For example a murder mystery is an exercise in deduction. Ultimately you need to work on maximizing your tax deductions regardless of where you are in the development or operation of your business.

A tax deduction isnt as simple. Gifts to clients and employees are 100 percent deductible up to 25 per person per year. Filing Taxes for Dummies.

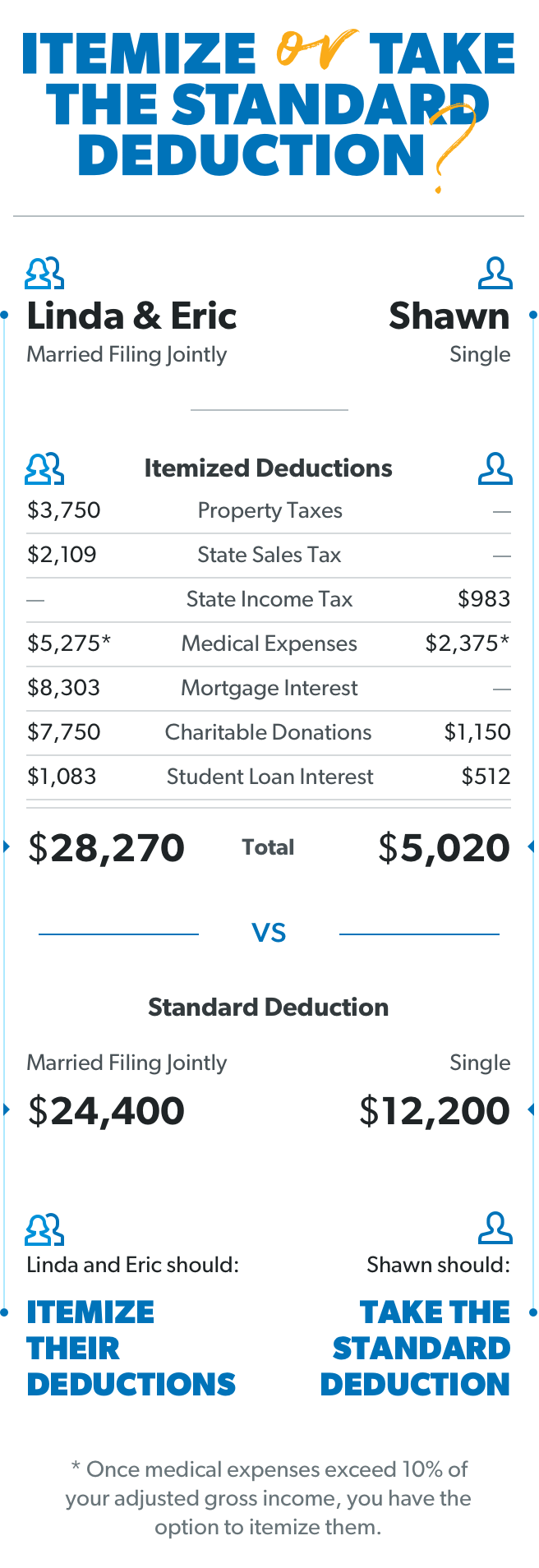

Receiving a tax deduction of anywhere from 12200 to 24400 might seem attractive. Licenses and regulatory fees also are considered taxes by IRS rules for this purpose. If you are filing as head of household you can deduct 9350.

Is 100 percent deductible. Certain taxes are deductible on federal income taxes. Credits for self-employed workers.

Standard Tax Deduction If you did the math and didnt have enough itemized deductions to get you above 6350 for singles and 12700 for marrieds you can take the standard tax deduction. A 5-Step Guide for Amateur Filers 26 April 2020 Personal Taxes Its exciting to bring home a paycheck and enjoy the fruits of your labors especially if youre just starting out on your own. Home Office Tax Deduction The home office deduction allows you to deduct 5 per square foot up to 300 square feet for exclusive home office space.

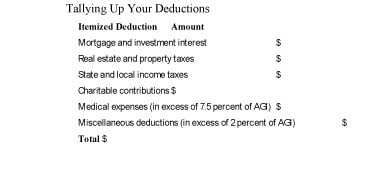

Deductible medical expenses include medical insurance premiums you pay doctors fees hospital and lab fees prescription drugs medical supplies dental and vision care costs and supplies. Taxable income is your adjusted gross income less your standard deduction 12550 in 2021 for singles 18800 for heads of householder and 25100 for MFJ or your itemized deductions. Therefore making the best use of the deductions available to you will free up your business funds and profits for long-term success.

Those married filing jointly can claim a 24400 standard deduction and taxpayers filing as head of household that is single individuals with dependentscan claim a standard deduction of 18350. If you are not sure whether you should itemize your tax deductions the following general guidelines should help you along the way. Any expense related to tax service or education.

You can also write off premiums for your spouse and qualified dependents. If you have an effective tax rate of 30 percent you will save yourself an additional 1500 in taxes by itemizing 5000 x 030 1500. For each dollar that exceeds the standard deduction you will reduce your taxable income by that amount.

Because deduction rhymes with reduction you can easily remember that in deduction you start with a set of possibilities and reduce it until a smaller subset remains. Although medical expenses are deductible you likely wont get to deduct these expenses because they must exceed 75 percent of your AGI to apply. Basically if you own a small business and it generates 100000 in profit in 2019 you can deduct 20000 before ordinary income tax rates are applied.

The 10000 tax deduction saves you 2000. For example assume your itemized deduction exceeds the standard deduction by 5000. While tax deductions lower your taxable income tax credits cut your taxes dollar for dollar.

There are a few limits however that could prevent you from claiming this deduction. Here are some common deductions. Typically the detective begins with a set of possible suspects for example the butler the maid the.

If your effective tax rate is say 20 then instead of paying 20 of 100000 ie 20000 you can take the deduction and only pay 20 of 90000 18000. According to the IRS If you are single and your adjusted gross income is more than 259400 or 311300 if married and filing jointly then you may be limited in the deductions you can take. Deductible taxes also consist of employer taxes including the employer share of FICA FUTA and state unemployment taxes.

So a 1000 tax credit cuts your final tax bill by exactly 1000. When you do your tax return you can claim most business expenses as tax deductions to reduce your taxable income. Accounting or bookkeeping fees for keeping records of investment income.

Self-employed earners can deduct the cost of their health insurance including dental and qualified long-term care premiums. Computer expense you can take a depreciation deduction for your computer if you use it 50 percent of the time or more for managing your investments.

Laws Of Money Money Management Advice Financial Quotes Business Money

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

78 Tax Tips For Canadians For Dummies Henderson Christie Quinlan Brian Schultz Suzanne 9780470676585 Books Amazon Ca